Health Insurance vs. Life Insurance: Understanding the Key Differences

When it comes to financial security, both health insurance and life insurance play crucial roles. However, they serve different purposes and cater to different needs. Understanding the differences can help you make informed decisions to secure your future and that of your loved ones.

What is Health Insurance?

Health insurance is designed to cover medical expenses, including hospitalization, doctor visits, medications, and preventive care. It helps reduce out-of-pocket costs and ensures you receive necessary medical treatment without financial stress.

Benefits of Health Insurance:

- Covers hospitalization and medical expenses

- Includes preventive care and wellness check-ups

- Reduces financial burden in case of medical emergencies

- Some plans cover pre-existing conditions and chronic diseases

- Can provide access to a network of healthcare providers

What is Life Insurance?

Life insurance provides financial support to your beneficiaries in the event of your death. It ensures that your loved ones receive a lump sum payout, helping them manage expenses like mortgage payments, education, and daily living costs.

Benefits of Life Insurance:

- Provides financial security for your family after your passing

- Helps cover funeral costs and outstanding debts

- Can serve as an income replacement for dependents

- Some policies offer cash value accumulation and investment benefits

- Offers peace of mind knowing your loved ones are protected

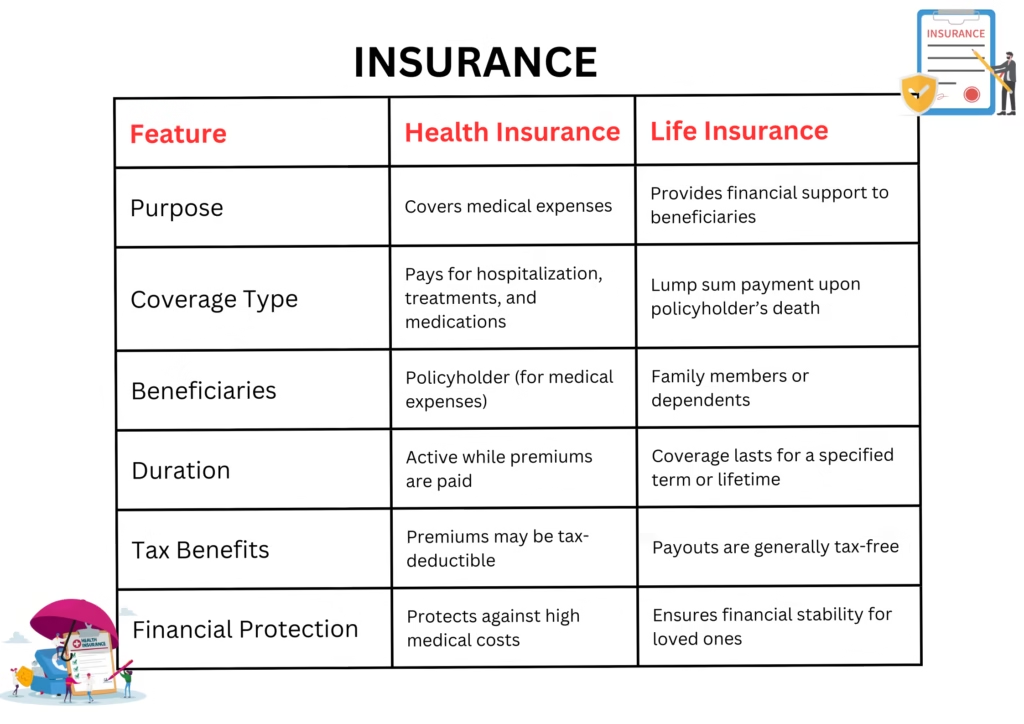

Key Differences Between Health Insurance and Life Insurance

| Feature | Health Insurance | Life Insurance |

|---|---|---|

| Purpose | Covers medical expenses | Provides financial support to beneficiaries |

| Payout Type | Pays for hospital bills and treatments | Lump sum payment to beneficiaries |

| Beneficiaries | Policyholder (for medical expenses) | Family members or dependents |

| Duration | Active while premiums are paid | Coverage lasts for a specified term or lifetime |

| Tax Benefits | Premiums may be tax-deductible | Payouts are generally tax-free |

Which One Do You Need?

Choosing between health insurance and life insurance depends on your priorities:

- If you want to protect yourself from high medical costs, health insurance is essential.

- If you want to secure your family’s financial future, life insurance is a must-have.

- Ideally, a combination of both provides comprehensive financial security.

Frequently Asked Questions (FAQs)

1. Can I have both health and life insurance?

Yes, both types of insurance serve different purposes, and having both ensures complete financial protection.

2. Is life insurance more expensive than health insurance?

It depends on factors like age, health condition, coverage amount, and policy type. Term life insurance is generally more affordable than whole life insurance.

3. Does life insurance cover medical expenses?

No, life insurance provides a payout to beneficiaries upon the policyholder’s death. It does not cover medical bills.

4. What happens if I don’t have health insurance?

Without health insurance, medical expenses can become a significant financial burden, leading to debt or limited access to healthcare services.

5. Can I change my insurance policy later?

Yes, many insurance providers allow you to upgrade or switch policies based on changing needs and circumstances.

Conclusion

Both health insurance and life insurance are vital for financial well-being. Health insurance ensures you get the necessary medical treatment without financial strain, while life insurance provides long-term security for your loved ones. Understanding their differences and benefits can help you make the right choice for your financial future. For more information Subscribe Healthfitessentials